Can DAOs replace corporations?

DAOs enable people to form organizations with decentralized leaders, run on top of a cryptocurrency where the community and believers have a decentralized voting power as tokens instead of shares. They're often described as a way for people to avoid the hierarchical centralized systems in corporations.

As DEFi came to build a new internet-native financial system, DAOs are here to decentralize the governance layer in legacy business structures and offer the promise of enabling a focus on community, rather than just profit.

#What is a DAO ?

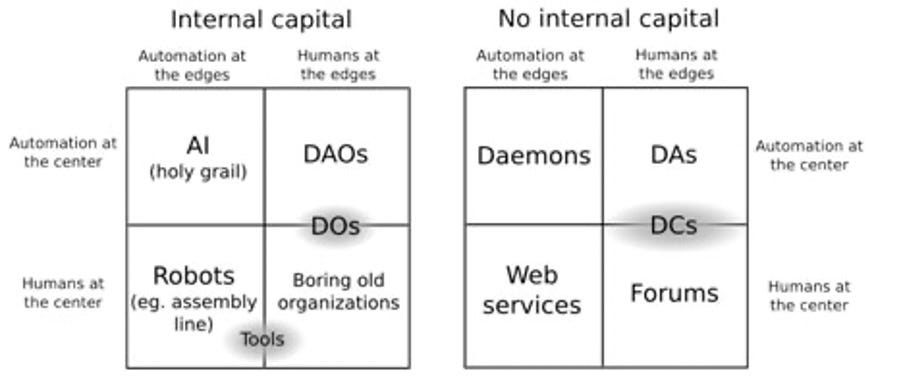

In 2013, co-founder of Bitshares, Steem, and EOS blockchain Dan Larimer described Bitcoin as a type of DAO, using the metaphor of cryptocurrencies as shares in a “Decentralized Autonomous Corporation” (DAC) with the goal of earning profit for shareholders by providing services on the free market. Five days later, then author at Bitcoin Magazine Vitalik Buterin (now co-founder of the Ethereum blockchain), pointed out that corporations are “nothing more than people and contracts all the way down”.

The concept of DAOs has since been popularized by blockchain communities, especially in the Ethereum ecosystem. The software language of the Ethereum protocol allows automated, smart contracts for the enactment of composable governance processes and mechanisms, and DAOs are proliferating as an open field of experimentation in automation, governance, and autonomy. DAOs have been referred to as a site of algorithmic governance for further ethnographic enquiry.

#DAO lifecycle

DAOs are undertaking different ways towards becoming a DAO. The majority takes a transition through a progressive route to decentralization.

The typical growth of a DAO consists of Idea stage, getting believers, early contributors, token raise, governance setup, treasury setup, development program, sustainable revenue and full decentralization.

According to Yury Lifshits the founder of SuperDAO we can define each stage as following :

*Idea stage

Leader + purpose + name

To get started, one needs a name for the DAO (can be a working title), a leader, and the purpose of the organization. The purpose needs to be stated from the perspective of members and supporters (why we want this DAO to exist) and not from the perspective of the creator. In other words, articulate what kind of good things the DAO will make for its members and the general public.

*Believers

Founding members + written roadmap + public profile

Manually invite most ideologically motivated people and draft together a plan of action. How do you want the DAO to work and what are you planning to make? The decisions on tokens, NFTs, and governance systems can wait, focusing primarily on value creation at this point. With founding members and a draft roadmap, an “upcoming DAO” profile can be created to attract more members.

*Early contributors

Contributor loop + reward system

Figure out the most common and repeatable tasks the early members can do to help your DAO. Then, propose rewards for those actions. Rewards can include special achievements NFTs (designed for status, not speculation), whitelist membership for future NFT minting and token airdrops, and options to buy future NFTs/tokens at an exceptionally low price.

*Initial capitalization

Token raise or primary NFT sale

Introduce DAO’s main token or its primary NFT collection representing membership. By this stage you will have two types of members — the ones who earn their membership via labor contributions and the one acquired through primary sale. In other words, you are now mixing “work to join” with “buy to join” models. You still can be pre-screening buyers and limiting the secondary market for memberships if it's important for your specific DAO.

*Governance setup

Partial decentralization + voting

Transferring some governance rights from creator to community. Typical decisions to delegate include financial parameters (“tax rate”), curation, investing, featuring, budget and grant approval, token allocations, and elected roles.

*Treasury setup

Treasury composition + liquidity + spend management

Diversifying DAOs treasury to include its native token, unminted primary NFTs, major coins, stable coins, tokens from related DAOs (e.g. from the blockchain of choice) and fiat. Partnering with liquidity providers and lenders for loans, guaranteed exchange rates, and yield programs to generate more interest and currencies needed for contributor compensation.

*Development program

Payroll + grants + project-based hiring + bounty program + programmatic incentives

Recruiting contributors, including engineering, business roles, influencers, customers, and ecosystem partners. Using fiat, token and NFT-based compensation models. Automating rule-based compensation, including giveaways and airdrops.

*Sustainable revenue

Member dues + secondary royalties + service review + licensing

Long term revenue models for DAOs include annual fees for holding membership NFTs (aka “property tax”), royalties from secondary NFT trading, paid services and gas fees, DAO-owned IP licensing.

*Full decentralization

Governance layer + operating layer

Separating governance activities (policy, budgeting) and operating layer (an ecosystem of “labs” providing development and operation services. The main token may be split into a governance token (voting powers) and a utility token (ecosystem currency) at this point.

To be more accurate, there is no 100% correct framework for starting a DAO and each DAO one has its own and unique journey.

#Why DAOs fail ?

Because they are vulnerable to both social and technical attacks, DAOs are likely to fail.

Based on the ethereum blog: DAOs are vulnerable to collusion attacks … In a democracy, for example, the whole point is that a plurality of members choose what they like best and that solution gets executed; in Bitcoin on the other hand, the “default” behavior that happens when everyone acts according to individual interest without any desire for a specific outcome is the intent, and a 51% attack to favor a specific blockchain is an aberration.

Technical attacks can be software code bugs creating security errors.

Alyssa Hertig also stated that unstoppable code can pose a problem: It’s difficult to change the rules of the DAO once it’s deployed to the Ethereum blockchain. The same framework that prevents a person or entity from altering the organization without consensus from the community can also cause problems, the main one being that any gaps in the framework aren’t easily closed. That can lead to potential theft, money loss or other disastrous consequences.

Conclusion

I believe DAOs potentially have the ability to transform the legacy business structure despite the absence of a clear framework for DAOs including the legal part. Wyoming passed a law earlier the year of 2021 that recognized DAOs and gave them the same legal power as LLCs. However they are still unrecognized. Until that happens, they're likely to be widely adopted.

#Bonus

To obtain legal status as a registered corporate entity (in the US), a DAO must:

- be deployed on a public blockchain

- provide a unique public address so anyone can view their operations

- software code must be open-source, software code must be audited, laypeople able to read smart contract variables and token restrictions

- governance must be decentralized in the technical architecture of the DAO

- at least one DAO member

- a contact point

- a binding dispute resolution mechanism for participants

- a dispute resolution mechanism for interacting with third parties, outside of the DAO.

I hope you enjoyed reading about this topic, if you would like to explore more here are the resources :